Homeowners insurance is a crucial financial safety net for property owners, designed to protect against various risks that can lead to significant financial loss. At its core, this type of insurance typically covers the structure of the home, personal belongings, liability for injuries sustained on the property, and additional living expenses if the home becomes uninhabitable due to a covered event. However, the specifics of coverage can vary widely between policies, making it essential for homeowners to thoroughly understand what their policy entails.

One of the primary components of homeowners insurance is dwelling coverage, which protects the physical structure of the home from perils such as fire, theft, vandalism, and certain natural disasters. Additionally, personal property coverage safeguards belongings within the home, including furniture, electronics, and clothing. Liability coverage is another critical aspect, providing financial protection in case someone is injured on the property and decides to sue.

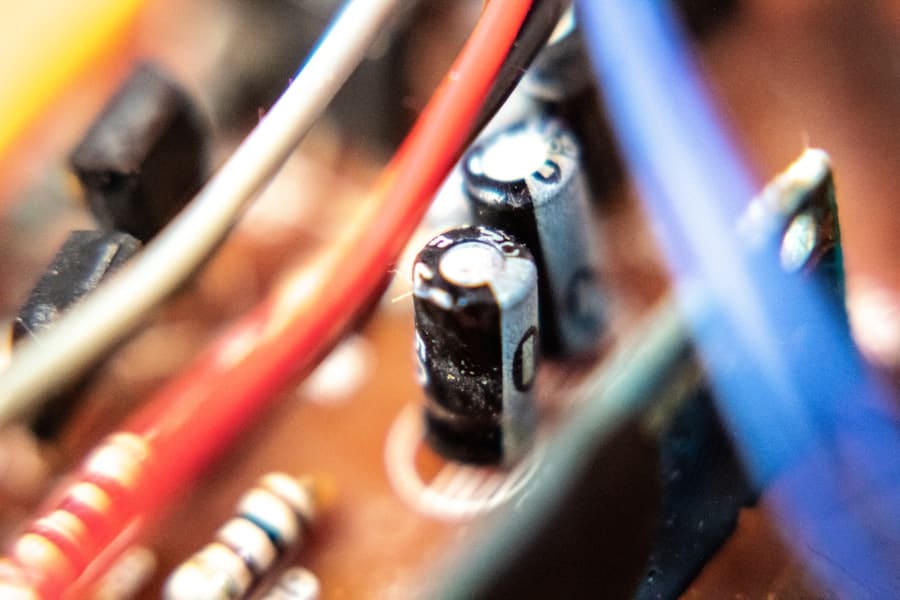

Understanding these elements helps homeowners assess their risk exposure and ensure they have adequate protection against potential electrical issues that may arise.

Key Takeaways

- Homeowners insurance coverage for electrical repairs varies and often excludes certain types of damage or wear.

- Regular maintenance and timely upgrades are crucial to prevent electrical issues and ensure insurance claims are valid.

- Understanding policy exclusions, deductibles, and claim procedures helps homeowners make informed decisions about repairs.

- Professional assessment and proper documentation are essential when filing claims for electrical repairs.

- Exploring alternatives to insurance, such as warranties or service plans, can provide additional financial protection for electrical issues.

Types of Electrical Repairs Covered by Insurance

When it comes to electrical repairs, homeowners insurance can cover a range of issues, but the specifics depend on the nature of the damage and the cause. For instance, if an electrical fire occurs due to faulty wiring or a short circuit, homeowners insurance typically covers the resulting damage to both the structure and personal property. This includes costs associated with repairing or replacing damaged electrical systems, as well as any structural repairs needed due to fire damage.

Moreover, if a power surge caused by a lightning strike damages electrical appliances or systems within the home, many policies will cover the cost of repairs or replacements. This can include everything from damaged circuit breakers to ruined appliances like refrigerators or televisions. However, it is essential for homeowners to review their specific policy details, as coverage can vary significantly based on the insurer and the terms outlined in the policy.

Exclusions and Limitations in Insurance Policies

While homeowners insurance provides valuable coverage for electrical repairs, it is equally important to be aware of exclusions and limitations that may apply. Many policies exclude damage resulting from wear and tear or lack of maintenance. For example, if an electrical system fails due to age or neglect, the insurer may deny a claim on the grounds that it falls outside the scope of covered perils.

This highlights the importance of regular maintenance and timely upgrades to electrical systems. Additionally, certain types of damage may not be covered under standard homeowners insurance policies. For instance, damage caused by flooding or earthquakes often requires separate policies or endorsements.

Homeowners should carefully read their policy documents to identify any exclusions that could impact their coverage for electrical repairs. Understanding these limitations can help homeowners make informed decisions about additional coverage options or endorsements that may be necessary to protect against specific risks.

Importance of Regular Maintenance and Upgrades

Regular maintenance and timely upgrades to electrical systems are vital for preventing issues that could lead to costly repairs and potential insurance claims. Over time, electrical systems can degrade due to factors such as age, environmental conditions, and increased demand from modern appliances. Homeowners should schedule routine inspections by qualified electricians to identify potential hazards like frayed wiring, overloaded circuits, or outdated panels that may pose risks.

Upgrading electrical systems not only enhances safety but can also improve energy efficiency. For example, replacing old incandescent bulbs with energy-efficient LED lighting can reduce energy consumption and lower utility bills. Furthermore, modernizing an electrical panel can accommodate increased power demands from new appliances or smart home technology.

By investing in regular maintenance and upgrades, homeowners can mitigate risks and potentially avoid situations that would necessitate filing an insurance claim.

When to File a Claim for Electrical Repairs

Determining when to file a claim for electrical repairs can be a nuanced decision for homeowners. Generally, it is advisable to file a claim when the cost of repairs exceeds the deductible amount specified in the insurance policy. Homeowners should gather estimates from licensed electricians to assess whether the repair costs warrant filing a claim.

If the damage is extensive—such as significant fire damage or widespread electrical failure—filing a claim may be necessary to cover substantial repair costs. However, homeowners should also consider their claims history before proceeding. Frequent claims can lead to higher premiums or even difficulty obtaining coverage in the future.

Therefore, if repair costs are close to or below the deductible amount, it may be more prudent to pay out-of-pocket rather than risk potential increases in insurance rates. Each situation is unique, and weighing the financial implications of filing a claim versus self-funding repairs is crucial for making informed decisions.

Factors Affecting Insurance Coverage for Electrical Repairs

Several factors influence how homeowners insurance covers electrical repairs. One significant factor is the age and condition of the home’s electrical system at the time of damage. Insurers may scrutinize whether proper maintenance was performed and whether any upgrades were made to meet current safety standards.

Homes with outdated wiring or systems that do not comply with local codes may face challenges in obtaining full coverage for repairs. Another factor is the cause of the electrical issue. Claims resulting from sudden incidents like lightning strikes or power surges are more likely to be covered than those stemming from gradual deterioration or neglect.

Additionally, geographic location plays a role; homes in areas prone to severe weather events may have different coverage options or requirements compared to those in more stable climates. Understanding these factors can help homeowners navigate their insurance policies more effectively.

The Role of Deductibles in Electrical Repair Claims

Deductibles are a critical component of homeowners insurance policies that directly impact how much homeowners will pay out-of-pocket when filing a claim for electrical repairs. A deductible is the amount that policyholders must pay before their insurance coverage kicks in. For example, if a homeowner has a $1,000 deductible and incurs $5,000 in electrical repair costs due to a covered event, they would be responsible for paying the first $1,000 while their insurer would cover the remaining $4,000.

Choosing an appropriate deductible amount is essential for balancing premium costs with potential out-of-pocket expenses during claims. Higher deductibles often result in lower monthly premiums but can lead to significant expenses if a major repair is needed. Conversely, lower deductibles may increase monthly costs but provide more immediate financial relief in case of damage.

Homeowners should carefully evaluate their financial situation and risk tolerance when selecting their deductible levels.

Seeking Professional Help for Assessment and Documentation

When dealing with electrical repairs that may require insurance claims, seeking professional help for assessment and documentation is crucial. Licensed electricians can provide detailed evaluations of damage and necessary repairs, which are essential for substantiating claims with insurers. Their expertise ensures that all aspects of the damage are accurately documented and that any necessary repairs are identified.

In addition to assessments by electricians, homeowners should also keep thorough records of all communications with their insurance company throughout the claims process. This includes documenting conversations, saving emails, and maintaining copies of all estimates and invoices related to repairs. Having comprehensive documentation not only supports claims but also helps resolve any disputes that may arise during the claims process.

Tips for Maximizing Insurance Coverage for Electrical Repairs

To maximize insurance coverage for electrical repairs, homeowners should take proactive steps before any issues arise. First and foremost, maintaining an up-to-date inventory of personal property can facilitate smoother claims processing in case of damage. This inventory should include photographs and receipts for valuable items like electronics and appliances.

Additionally, homeowners should regularly review their insurance policies to ensure they understand their coverage limits and any endorsements that may enhance protection against specific risks related to electrical systems. Engaging with an insurance agent can provide insights into potential gaps in coverage and suggest additional options tailored to individual needs. Furthermore, keeping records of maintenance activities performed on electrical systems can demonstrate diligence in upkeep and potentially strengthen claims if issues arise.

Alternatives to Insurance Coverage for Electrical Repairs

While homeowners insurance provides essential coverage for electrical repairs, there are alternatives that homeowners might consider as supplementary options. One such alternative is a home warranty plan that specifically covers repairs or replacements of major home systems and appliances, including electrical systems. These plans often provide peace of mind by covering unexpected breakdowns without requiring a deductible payment.

Another option is setting aside funds in a dedicated emergency savings account specifically earmarked for home repairs. This approach allows homeowners to self-fund smaller repairs without impacting their insurance premiums or claims history. By having readily available funds for emergencies, homeowners can address issues promptly while maintaining their insurance policy’s integrity.

Making Informed Decisions for Electrical Repairs

Navigating homeowners insurance coverage for electrical repairs requires careful consideration and informed decision-making. By understanding policy details, recognizing exclusions and limitations, and prioritizing regular maintenance, homeowners can better protect themselves against unexpected costs associated with electrical issues. Additionally, knowing when to file a claim and how deductibles impact financial responsibilities is crucial for managing repair expenses effectively.

Ultimately, being proactive about home maintenance and staying informed about insurance options empowers homeowners to make sound decisions regarding electrical repairs while maximizing their coverage potential. Whether through traditional insurance policies or alternative solutions like home warranties or emergency savings accounts, having a comprehensive strategy in place ensures that homeowners are prepared for whatever challenges may arise in maintaining their properties’ electrical systems.

When considering whether insurance covers electrical repairs, it’s also important to understand the potential risks that can lead to such repairs. For instance, surge protection is crucial, especially during hurricane season, as power surges can cause significant damage to your electrical systems. To learn more about the importance of surge protection for your home, you can read our article on surge protection in Southwest Florida during hurricane season.

FAQs

Does homeowners insurance cover electrical repairs?

Homeowners insurance typically covers electrical repairs only if the damage is caused by a covered peril, such as a fire or lightning strike. Routine electrical system failures or wear and tear are generally not covered.

Are electrical repairs due to power surges covered by insurance?

Coverage for electrical repairs caused by power surges depends on the specific insurance policy. Some policies include protection against power surges, while others may require additional endorsements or riders.

Will insurance cover electrical repairs after a storm?

If electrical damage results from a storm-related event like lightning, wind, or falling trees, insurance usually covers the repairs. However, damage from flooding or sewer backup may require separate flood or sewer backup insurance.

Does insurance cover electrical repairs for outdated wiring?

Insurance generally does not cover repairs or upgrades for outdated or faulty wiring due to normal wear and tear. These are considered maintenance issues and are the homeowner’s responsibility.

What should I do before filing a claim for electrical repairs?

Before filing a claim, document the damage with photos, review your insurance policy to understand coverage, and contact your insurance agent to discuss the claim process and any deductibles.

Are there any exclusions related to electrical repairs in insurance policies?

Yes, common exclusions include damage caused by neglect, faulty workmanship, gradual deterioration, and pre-existing conditions. Always review your policy for specific exclusions related to electrical systems.

Can renters insurance cover electrical repairs?

Renters insurance typically does not cover electrical repairs to the building’s wiring, as this is the landlord’s responsibility. Renters insurance mainly covers personal property and liability.

Is it necessary to have a home inspection for electrical issues before buying insurance?

Many insurers require a home inspection to assess electrical systems before issuing a policy. Identifying and addressing electrical issues beforehand can prevent coverage denials or higher premiums.